Agricultural Operations! Business Operations! Get 100% Financing at a low 6% interest rate for Energy Efficiency and Renewable Energy (EE/RE)! Start saving more money now!

Benefits

- 100% Financing of your EERE Project

- Borrow up to BZD $300,000

- LOW 6% Interest rate

- Interest is on the Reducing Balance

- Payback period up to 22 years

- Grace Period up to 1 year.

- Repay Loan from SAVINGS generated!

Sectors

- Agriculture / Farms

- Commercial / Office Buildings

- Manufacturers

- Resorts, Hotels etc.

- Service Industry – Restaurants etc.

- Vehicles / Transportation Industry

- Any other High Energy Consumption Business

Get EE/RE Loans for:

- Electric or Hybrid Vehicles for Business

- Solar Panel Power Systems

- Solar Water Heating Systems

- Irrigation or Water Drainage

- Rain Water Catchments & Water Recycling

- Air Conditioning / Refrigeration Equipment

- Low Flow Toilets and Faucets

- Solar Lighting & LED Lighting

- Cool Roofing

- Building Insulation, Insulated Windows

- Wind turbines

- Hydro Systems

- Alternative Fuels (Biogas, Bio Diesel etc.)

Application Requirements:

- Valid Photo ID – Social Security Card or Passport

- Energy Report or Audit (From Green Energy Service Provider)

- Cost Estimate (Cost for Equipment & Labor)

- Proof of Income (Employment Letter and 6 month Pay Slips)

- Income Statement (If Business or Self Employed)

- Proof of Property Ownership (Title)

- Security | Collateral: Flexible collateral accepted including Promissory note, Charge on EE/RE Equipment, 3rd Party Guarantors, Real estate or a combination thereof.

- Company Documents: If a Company is borrowing: Certificate of Incorporation, Memorandum and Articles of Association, Resolution to Borrow, Certificate of Good Standing, Authorized Signatories

- ELIGIBILITY: Belizeans, Belizean Residents, Non-Nationals, and Legal Entities.

Financing Covers

- Rehabilitation of existing buildings aiming at increasing Energy Efficiency but not limited to lighting, air-condition, hot water heating, building envelope (windows, roof insulation)

- Renewable Energy and resource efficiency technologies such as photovoltaic (solar panels), solar water heaters, and solar dryers

- Improvement or replacement of production equipment increasing energy efficiency including but not limited to chillers, refrigeration equipment, boilers, air compressors

- Purchasing and installation of equipment, auxiliary equipment, and materials

- Transportation costs, demolition costs, import taxes and duties, and any value-added tax associated with these costs.

- Cost of works necessary for installing and operating equipment such as equipment foundations, gas pipelines

- Fees for an energy audit, project development, engineering design, and supervision

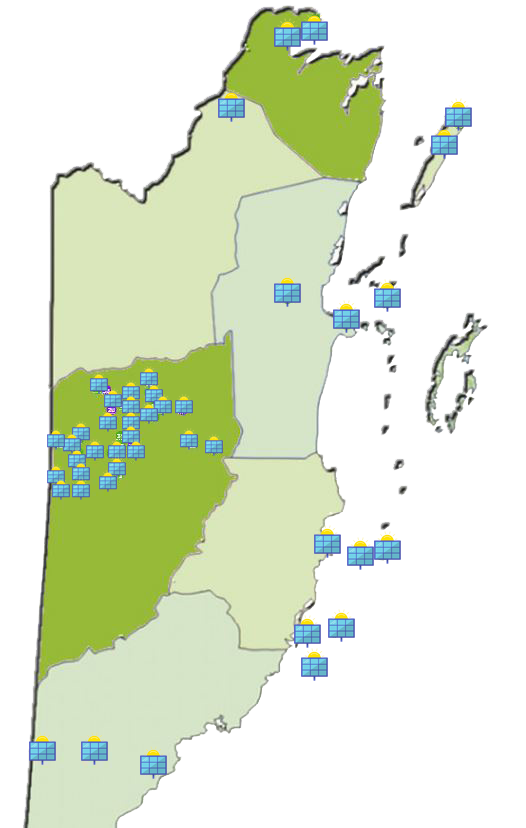

Solar PV Installations in Belize

Businesses across Belize are investing in Renewable Technologies.

The Map above illustrates Solar PV systems which ONLY one Green Energy Service Provider has installed in Belize.

Isn’t it time your business START SAVING MONEY by investing in Renewable Energy Technologies?