100% Home Financing! Affordable repayments! PLUS more! …DFC is your BEST CHOICE for home financing.

NOW GET 100% Home Financing!

- For all Belizeans and Residents.

- For Home Construction, Home Purchase, Land Purchase, Home Improvement, and Expansion.

- Get More! – Eligible for up to 45% of your income

- As low as 7.5% PLUS Interest is on reducing balance for the life of the loan.

- Up to 20 Years Loan Repayment Term

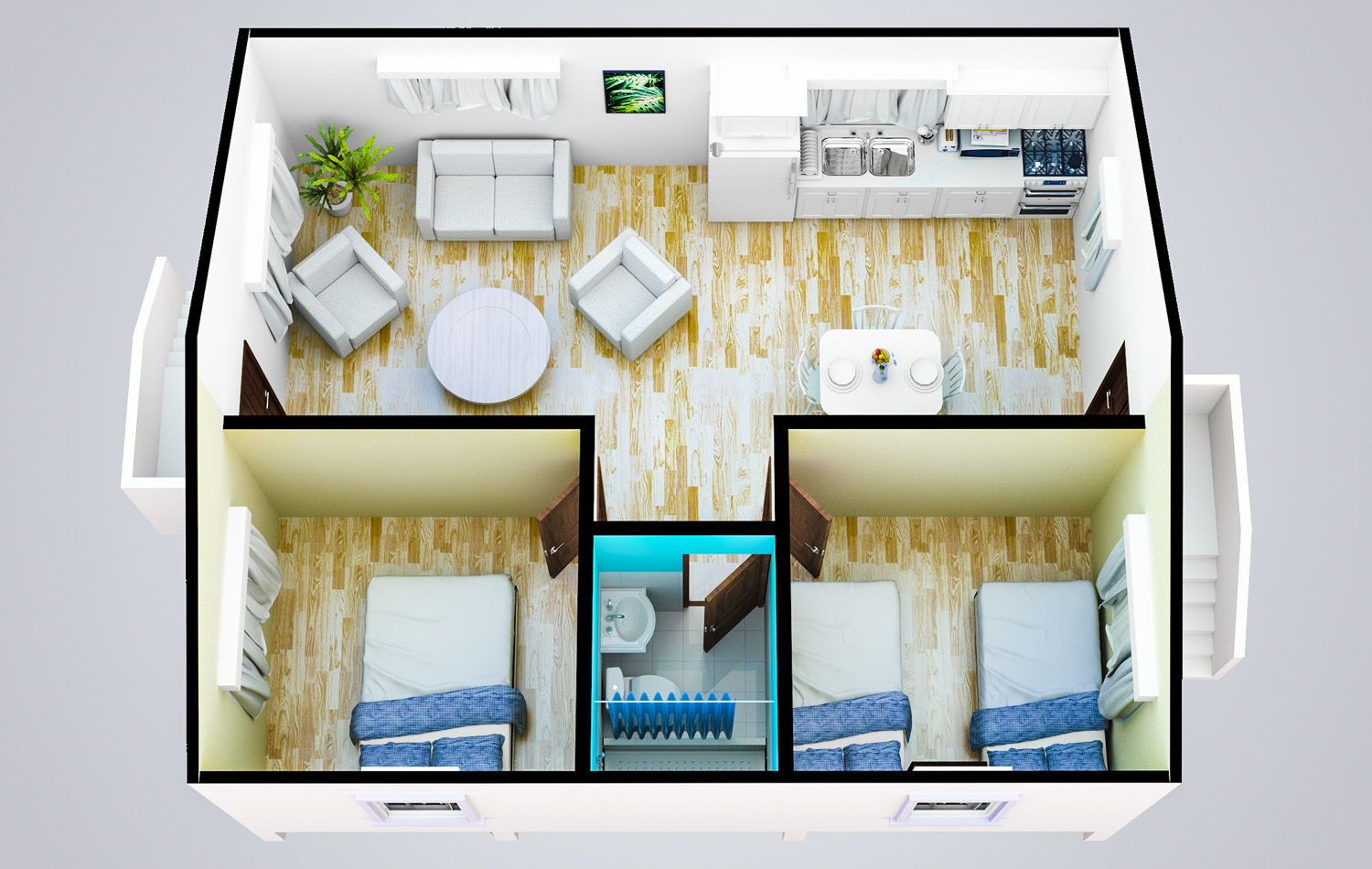

- Affordable 2 & 3 bedroom building plans

- Affordable Life & Building Insurance included

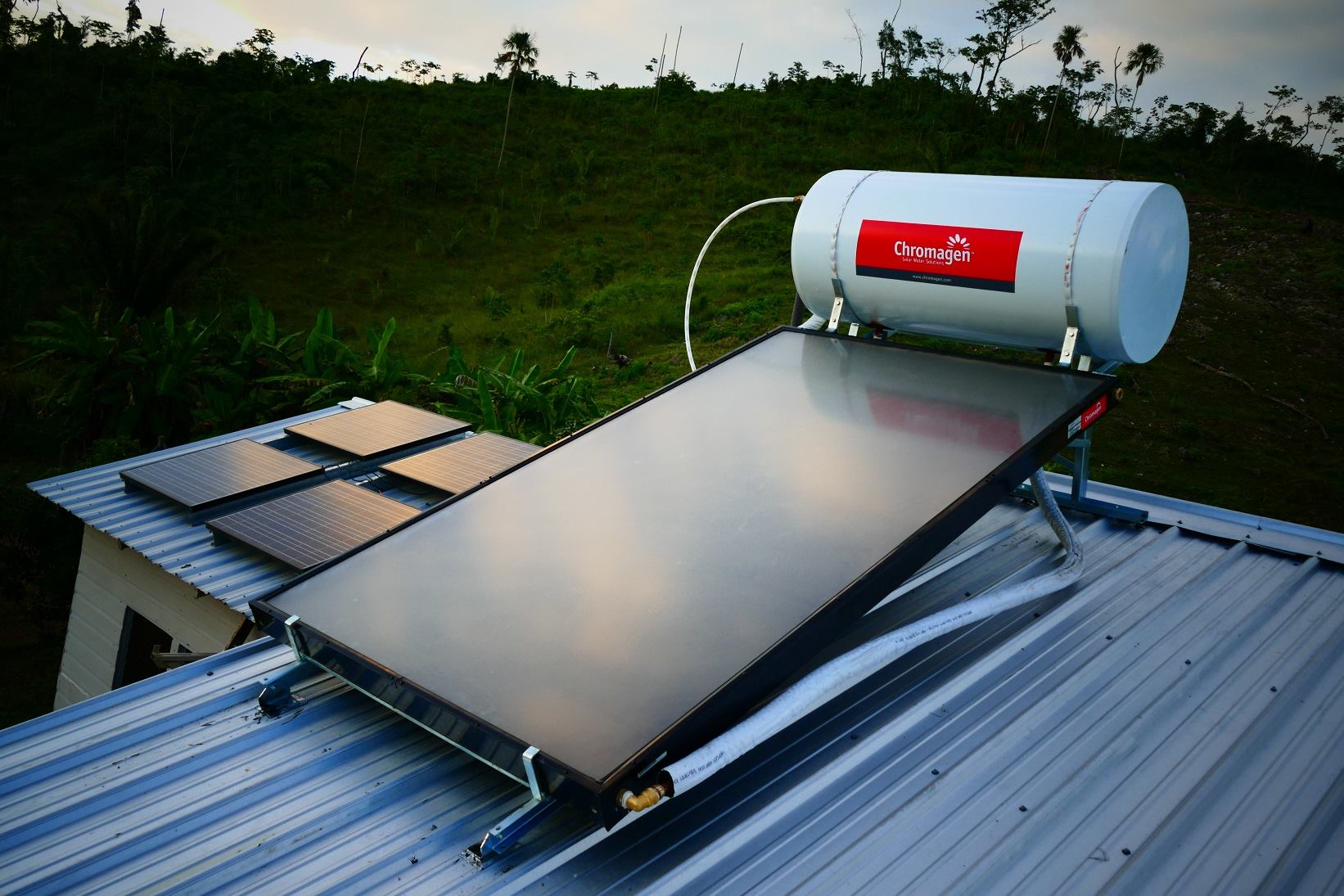

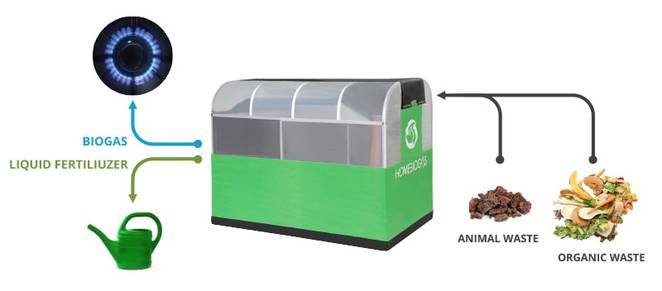

- Reduce your Home Energy Costs! Get Energy-efficient equipment for your home! (Low 6%)

Provide some initial info and a DFC Representative will contact you to discuss your loan interest or set up an appointment.

Twelve Home Products

Choose from TWELVE (12) DFC Homeownership products! CLICK on an option below to open and view application requirements.

Get 100% financing! You can apply to get the plans and build a 2 or 3 bedroom Starter Home. See the Starter Home Plans here.

If you have a title or lease property: You can apply to build immediately. The land and home, built would serve as collateral for the loan. See a list of requirements under Build your home if you already have a property

If you DO NOT have a property and want to buy a property you have identified and want to build your Starter home immediately: You would need to be making enough income or borrow with someone to ensure you would qualify for a DFC loan amount that can cover the cost of the land purchase as well as the construction of the home. See the list of requirements under Buy a property and build your home immediately.

If you are interested, fill in this form for us to assess your eligibility to borrow: Home Loan Eligibility Assessment Form

You can get 100% financing to first buy land and later get the loan to build your home. This is only if you are unable to qualify for an amount to both purchase a land and build a house at the same time.

What you need to apply:

- Photo ID (Social Security, Passport)

- Employment Letter or Certified Income Statement (If self-employed)

- Letter from Seller of the Property

- Land Documents – Title OR Lease

- Up to date Property Taxes (provided by the existing property owner)

After repaying most of the Property Loan and now ready to make a Home Loan.

- Building Plans (Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

- Bill of Quantities (Labor & Material Costs)

Important:

- It is better to apply for the loan with the DFC and have the DFC execute the Property Transfer because you would be able to commence with construction on the property while the property is being transferred. If you execute the land transfer on your own, you would need to wait until the transfer is completed before you would be able to commence construction on the property.

Get 100% financing to build your own home if you have your own land (lease or title) or have written authorization from a property owner to build on their property. (Eg. Family property) If you have land to build on, here is:

What you need to apply:

- Photo ID (Social Security, Passport)

- Employment Letter or;

- Certified Income Statement (If self-employed)

- Land Documents – Title OR Lease

- Updated Property taxes

- Building Plans (Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

- Bill of Quantities (Labor & Material Costs)

Important:

- If a lease land, you would need to secure a ‘Permission to Mortgage’ from the Lands Department to be able to access a loan for that property.

Get 100% Home Financing! You are able to get a loan to purchase a property and build your own home immediately if you are able to meet the monthly loan repayment amount.

You are able to meet the loan eligibility amount if A.) you make enough income to be able to service the loan or B.) you borrow with another person so your combined incomes enable you to meet the loan repayment amount. If you meet these requirements then please see:

What you need to apply:

- Photo ID (Social Security, Passport)

- Employment Letter or Certified Income Statement (If self-employed)

- Letter from Seller (Stating sale price and details of property)

- Land Documents – Title OR Lease

- Up to date Property Taxes (provided by the existing property owner)

- Building Plans (Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

- Bill of Quantities (Labor & Material Costs)

Important:

PROPERTY TRANSFER: It is better to apply for the loan with the DFC and have the DFC execute the Title Transfer because you would be able to commence with construction on the property while the property is being transferred. If you execute the title transfer on your own, you would need to wait until the transfer is completed before you would be able to commence construction on the property.

Get 100% Home Financing! You are able to get a loan to purchase a home immediately if you are able to meet the monthly loan repayment amount.

You are able to meet the loan eligibility amount if A.) you make enough income to be able to service the loan or B.) you borrow with another person so your combined incomes enable you to meet the loan repayment amount. If you meet these requirements then please see:

What you need to apply:

- Photo ID (Social Security, Passport)

- Employment Letter or Certified Income Statement (If self-employed)

- Letter from Seller (Stating sale price and details of property)

- Land Documents – Title OR Lease

- Up to date Property Taxes (provided by the existing property owner)

Improving the home

Once you meet the contribution and loan repayment criteria described above you can also get additional financing if you would like to also improve (fence, burglar bars etc), renovate or expand the home.

If only improving or renovating the home without breaking down any exterior walls, you would only need to provide:

- Bill of Quantities (Labor & Material Costs)

If Renovation or Expansion requires breaking any exterior walls, you would then need to provide:

- Building Plans (Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

Important:

PROPERTY TRANSFER: It is better to apply for the loan with the DFC and have the DFC execute the Title Transfer because you would be able to commence with construction on the property while the property is being transferred. If you execute the title transfer on your own, you would need to wait until the transfer is completed before you would be able to commence construction on the property.

Get 100% Home Financing! You are able to get a loan to purchase a home immediately if you are able to meet the monthly loan repayment amount.

- You would need to secure the home plan for your Home-building company.

- The home plan and land document would need to be presented to the Central Building Authority (CBA) or local building authority (LBA) for them to approve the plans and determine the approved placement of the home on the property.

- A Septic plan will also be required to be presented to the CBA. or LBA.

Loan Application Requirements:

- Approved Building Plans

- Land Documents – Title OR Lease

- Employment Letter or Certified Income Statement (If self-employed)

- Photo ID (Social Security, Passport)

- Up to date Property Taxes (provided by the existing property owner)

Improving the home

Once you meet the contribution and loan repayment criteria described above you can also get additional financing if you would like to also improve (fence, burglar bars etc), renovate or expand the home.

If only improving or renovating the home without breaking down any exterior walls, you would only need to provide:

- Bill of Quantities (Labor & Material Costs)

If Renovation or Expansion requires breaking any exterior walls, you would then need to provide:

- Building Plans (Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

Important:

PROPERTY TRANSFER: It is better to apply for the loan with the DFC and have the DFC execute the Title Transfer because you would be able to commence with construction on the property while the property is being transferred. If you execute the title transfer on your own, you would need to wait until the transfer is completed before you would be able to commence construction on the property.

Get 100% Financing for your Home Improvement Loan! You are able to get a loan to renovate or improve your home!

What you need to apply:

- Photo ID (Social Security, Passport)

- Employment Letter or Certified Income Statement (If self-employed)

- Up to date Property Taxes

Improving the home

If only improving or renovating the home without breaking down any exterior walls, you would only need to provide:

- Bill of Quantities (Labor & Material Costs)

If Renovation or Expansion requires breaking any exterior walls, you would then need to provide:

- Building Plans (Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

- Approved Building Plans – Are also required for Construction of Fences

Securing the Loan

- 1 Guarantor = up to $7,500

- 2 Guarantors = $7,500 to $15,000

- Real Estate = Above $15,000

Note:

You are able to meet the loan eligibility amount if A.) you make enough income to be able to service the loan or B.) you borrow with another person so your combined incomes enable you to meet the loan repayment amount.

Gett 100% Financing for your Home addition or expansion!

What you need to apply:

- Photo ID (Social Security, Passport)

- Employment Letter or Certified Income Statement (If self-employed)

- Up to date Property Taxes

- Bill of Quantities (Labor & Material Costs)

If breaking any exterior walls:

- Building Plans (Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

- Approved Building Plans – Are also required for Construction of Fences

Securing the Loan

- 1 Guarantor = up to $7,500

- 2 Guarantors = $7,500 to $15,000

- Real Estate = Above $15,000

Note:

You are able to meet the loan eligibility amount if A.) you make enough income to be able to service the loan or B.) you borrow with another person so your combined incomes enable you to meet the loan repayment amount.

You can get 100% financing for Fencing, Security Systems, Window Replacements, Burglar Bars etc.

What you need to apply:

- Photo ID (Social Security, Passport)

- Employment Letter or Certified Income Statement (If self-employed)

- Up to date Property Taxes

- Bill of Quantities (Labor & Material Costs)

If Renovation or Expansion requires breaking any exterior walls, you would then need to provide:

- Building Plans (Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

- Approved Building Plans – Are also required for Construction of Fences

Securing the Loan

- 1 Guarantor = up to $7,500

- 2 Guarantors = $7,500 to $15,000

- Real Estate = Above $15,000

Note:

You are able to meet the loan eligibility amount if A.) you make enough income to be able to service the loan or B.) you borrow with another person so your combined incomes enable you to meet the loan repayment amount.

The DFC offers 100% financing for you to build an Energy Smart home or upgrade your home to one. Reduce or cut your electricity bill by investing in Solar Power Lighting and Solar Water Heating. Install LED Lighting, buy high-efficiency air conditioners and electrical appliances, insulate your home, or buy insulated windows. Buy vats to capture rainwater or invest in home biogas systems to produce your own ‘butane’ gas for cooking.

Loans for RE/EE are super low at just 6% on the reducing balance, and you repay the loan from the savings you generate.

Here’s what you need to apply:

- Bill of Quantities (Labor & Material Costs) provided by an Energy Service provider

- Photo ID (Social Security, Passport)

- Employment Letter or Certified Income Statement (If self-employed)

- Property documents (Title or Lease)

- Up to date Property Taxes

Securing the Loan

- 1 Guarantor = up to $7,500

- 2 Guarantors = $7,500 to $15,000

- Real Estate = Above $15,000

100% Home Mortgage Refinancing is available to Teachers, Police Officers, BDF, Coast Guard, Public Officers, and Employees of Statutory Bodies. See DFC’s ‘We Serve’ Home loan for more information.

For the general public, Home refinancing may be possible based on assessment. It would need to be part of a larger project such as securing additional capital to improve your home. We would not be able to offer home refinancing if your home loan has been ‘bundled’ with consumer loans such as vehicles, credit cards, or other consumer-based loan types.

What you need to apply:

- Letter from your bank (Stipulating the Pay-off the balance owed)

- Photo ID (Social Security, Passport)

- Employment Letter or Certified Income Statement (If self-employed)

- Land Documents – Title OR Lease (From Bank)

- Up to date Property Taxes (provided by the existing property owner)

- Bill of Quantities (Labor & Material Costs) – for improvements to be made to the home.

- Building Plans – If any exterior wall is to be broken.

(Approved by your city/town council (local building authority) or by the Central Building Authority (CBA) in Belize City

DFC has a list of Foreclosed properties for sale.

Please note that we do not provide selling price or starting bid price for the properties.

DFC foreclosed properties are sold by secret bid submissions by persons interested in the property.

Please see here for what you need to know to purchase a DFC Foreclosed Property.

Click here to see our current available Foreclosed Properties.

Unless otherwise specified in any of the above:

- Eligibility Amount – Contact us to see how much you will qualify for.

- Increasing Eligibility Amount – To increase your eligibility amount so you can access the amount you need for the loan, Another person can borrow jointly with you. As such, their income would also be factored in enabling you to access the amount you need.

- No Equity or Land? If you do not have a lease or title property and your income does not qualify you for an amount to both purchase land and build immediately, then you can access financing via our Buy Land Now, Build Home After Home Program. See application requirements above.

- Lease Land – If you want to borrow and build on a lease you would need to secure a ‘Permission to Mortgage‘ from the Lands Department to be able to access a loan for that property.

- Building on Family Land or Someone Else’s Property – You are able to build on someone else’s property (eg; Family land) if you have written consent/authorization from the property owner to mortgage their property.

- Central Building Authority Approval – CBA-approved plans are required for any Home, Fencing, or other standing structure to be built on a property. If you are renovating a home but will not break any external wall, CBA approval is not required.

-

Securing the Loan

- Up to $7,500 required ONE guarantor

- $7,501 to $15,000 requires TWO guarantors

- Above $15,000 requires REAL ESTATE as Collateral

- Note: Consideration would be given to use 1 guarantor up to $15,000 if the guarantor is financially able to service the entire monthly loan repayment amount in the event the borrower defaults.

WHY YOU SHOULD GET YOUR LOAN FROM DFC

- We are honest and upfront with you! – No Hidden Fees!

- We work with you and help you through challenging times.

- Reducing balance interest! We don’t raise interest rates on you!

Click here for the TOP Reasons why you should choose DFC for your Business and Home Financing!

GET YOUR HOME LOAN!

Provide some initial info and a DFC Representative will contact you to discuss your loan interest or set up an appointment.

Choose a Home Model

2 or 3 Bedroom Building Plans. Flat roof, Elevated Homes, Concrete or Timber, Choose for these affordable, ready-made, already approved 2 and 3 bedroom building plans! Click here to view these models.

Cut your electric bill!

Reduce or Cut your electricity bill by investing in Solar Power Lighting and Solar Water Heating. Also get your own water supply by Rain Water Harvesting and invest in Home BioGas. Learn more here.